For millions of Americans, Social Security isn’t just a program—it’s a lifeline. However, a proposal by Donald Trump could drastically reshape this cornerstone of retirement security.

Central to Trump’s policy platform is a bold plan: the complete elimination of FICA withholding taxes. This could potentially increase the annual take-home pay for many Americans by as much as $12,897.

The Proposal: Eliminating FICA Withholding!

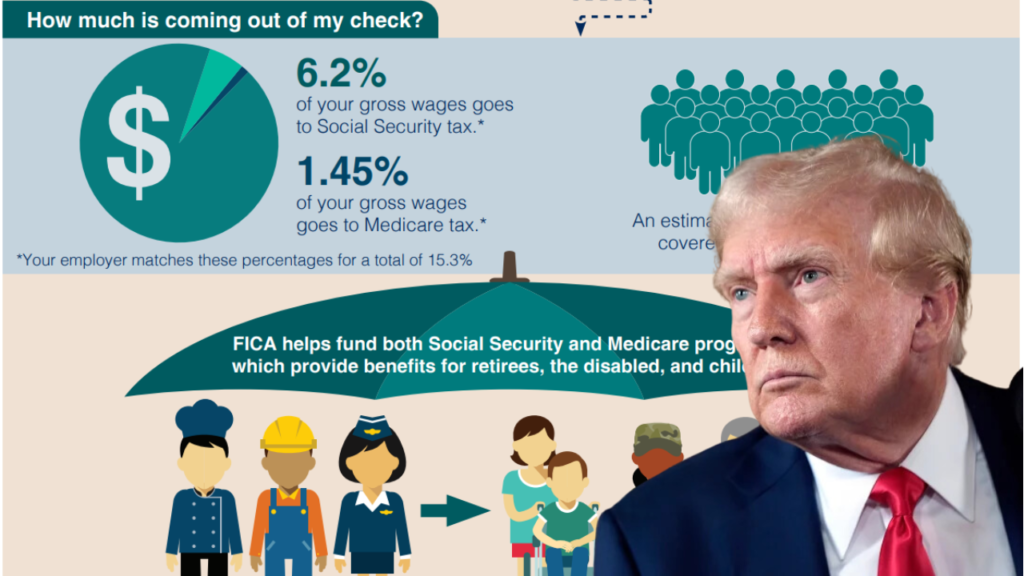

FICA—Federal Insurance Contributions Act—taxes are deducted from paychecks to fund Social Security and Medicare. During his 2020 campaign, Trump pledged to eliminate these taxes altogether.

The immediate effect of such a policy would be more money in the pockets of employed Americans, a significant shift in how these pivotal programs are funded.

Immediate Financial Implications!

If FICA taxes were removed, every American earning a salary would see an increase in their disposable income. For example, without the 7.65% FICA deduction, an individual earning $100,000 a year would save $7,650 annually in taxes.

However, Trump’s elimination plan targets even the employer’s contribution, doubling the potential savings to $15,300 for such earners. Thus, the figure of $12,897 represents an average across various income brackets.

Surprising Social Security Loophole for 50-Year-Old Retirees: Find Out If You Qualify!

Long-Term Consequences for Social Security!

While the immediate financial boost might seem beneficial, experts like Anthony Termini, a contributor at Annuity.org, warn of severe long-term implications. Without FICA’s funding, Social Security could face a significant shortfall.

As it stands, projections suggest that by 2033, payroll taxes will only cover about 79% of the program’s benefits. Eliminating these taxes could hasten or deepen that funding crisis, potentially jeopardizing future benefits for millions.

Political Considerations and Feasibility!

Such a radical overhaul of Social Security funding would require congressional approval, which is fraught with partisan challenges.

Historical attempts at major reforms have often been contentious, with stakeholders from across the political spectrum weighing in heavily.

The feasibility of Trump’s plan thus hinges not only on his election but also on the composition of future Congresses.

Goodbye to Regular SSI Checks in 2025 – Discover the 5 No-Pay Months!

Impact on Retirement Planning!

For affluent Americans, the prospect of reduced or uncertain Social Security benefits necessitates a reevaluation of retirement strategies.

Financial planners like Aaron Cirksena, CEO of MDRN Capital, suggest that those nearing retirement consider diversifying their portfolios and exploring alternative retirement income streams to buffer against potential disruptions in Social Security.

Conclusion

Donald Trump’s proposal to eliminate FICA withholding represents a significant pivot in how America’s key social programs are funded.

While it promises more money up front for workers, the potential risks to the long-term viability of Social Security are considerable.

As we move closer to another election cycle, understanding the full implications of these policy changes is crucial for every American, especially those planning for retirement.

Source: GOBankingRates