In an era where digital security is more crucial than ever, a recent massive data breach has sent shockwaves across the nation. Over 2.7 billion personal records have reportedly been compromised, potentially affecting every American.

This breach, involving sensitive information such as Social Security numbers, phone numbers, email addresses, physical addresses, and even banking information, is one of the largest ever recorded. Here’s what you need to know about this alarming situation and how to protect yourself.

The Scope of the Breach: What Happened?

The breach was traced back to National Public Data (NPD), a major company known for conducting background checks and handling personal information. The company has confirmed that multiple phishing and hacking attempts, dating from late 2023 to the summer of 2024, have resulted in the leak of nearly 2.7 billion data points. These include various pieces of personal information that, when combined, could be used for identity theft or other malicious activities.

What makes this breach even more concerning is the speculation that these data points could represent nearly every American. While it’s unclear whether this breach indeed covers the entire U.S. population, the potential impact is vast, affecting millions of people who may now be at risk of having their personal information misused.

What Does This Mean for You?

If you’re feeling anxious about this breach, you’re not alone. The exposure of such a vast amount of personal data raises significant concerns, especially when it comes to your financial security. If your Social Security number, phone number, or banking information is part of the leaked data, you might be vulnerable to identity theft or unauthorized financial transactions.

However, the effects of this breach may not be immediate. Often, after a breach, there is a lag before stolen information is used. Criminals may wait months or even years before using the data, making it critical to remain vigilant over the long term.

August Windfall: These Social Security Recipients Will See Double Payments – Are You One?

Steps You Can Take to Protect Yourself!

- Monitor Your Accounts: Regularly check your bank accounts, credit card statements, and other financial accounts for any suspicious activity. Report any unauthorized transactions immediately to your bank or financial institution.

- Check Your Credit Report: Obtain your free annual credit report from the three major credit bureaus—Equifax, Experian, and TransUnion. Look for any unfamiliar accounts or inquiries that could indicate fraudulent activity. Many banks and credit card companies offer free credit monitoring tools, which can alert you to changes in your credit report.

- Set Up Fraud Alerts: Consider placing a fraud alert on your credit report. This makes it harder for identity thieves to open accounts in your name. You can also consider freezing your credit, which prevents new credit from being issued in your name without your consent.

- Be Cautious with Your Information: In the wake of a breach, it’s natural to feel hesitant about sharing your personal information online. Be extra cautious about where you input sensitive data, and avoid providing your Social Security number or other personal details unless absolutely necessary.

- Watch for Scams: Be on the lookout for phishing emails or phone calls attempting to exploit the situation. Scammers often use breaches like this to trick people into revealing even more personal information.

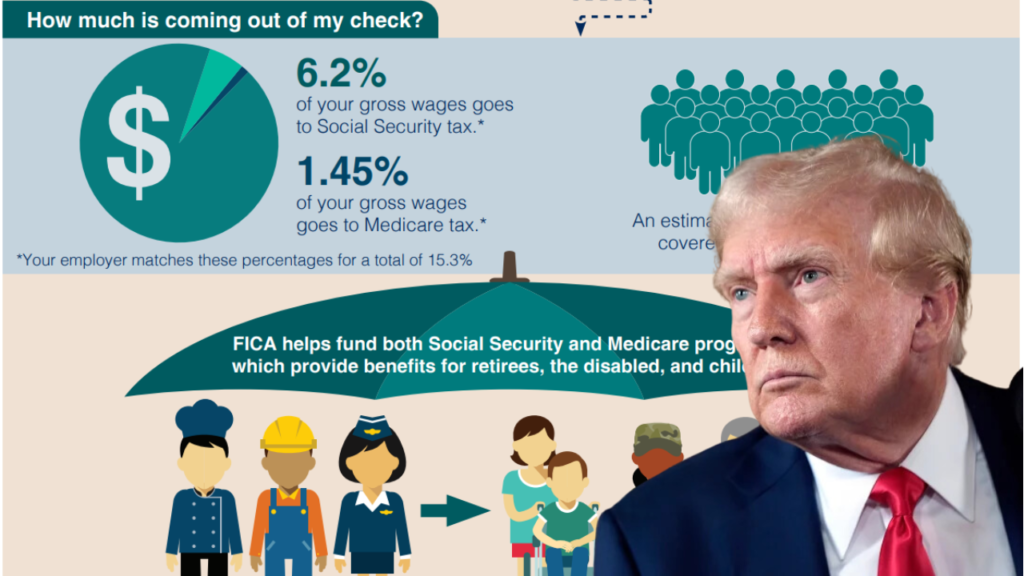

What About Social Security and Other Benefits?

A common concern among those affected by data breaches is whether their Social Security benefits or other government payments could be impacted. The good news is that your benefits should not be directly affected by this breach. However, if you notice any suspicious activity related to your benefits, such as unauthorized changes to your account, report it to the Social Security Administration immediately.

Moving Forward: Staying Informed

As this story continues to develop, staying informed is crucial. The full extent of the breach and its implications may not be known for some time, but taking proactive steps now can help mitigate the risks. Keep an eye on your accounts, stay cautious with your information, and consider enrolling in credit monitoring services if you haven’t already.

While this breach is indeed alarming, it’s important not to panic. By taking the necessary precautions and staying vigilant, you can protect yourself from potential fallout. And remember, you’re not alone in this—millions of others are facing the same challenges, and together, we can navigate this difficult situation.

3 Shocking Social Security Changes in 2025 That Could Cost You Big!

Conclusion: Don’t Lose Sleep Over It—But Stay Vigilant

It’s easy to feel overwhelmed when faced with the possibility that your personal data has been compromised. However, instead of losing sleep over it, focus on what you can do to protect yourself. Monitor your accounts, check your credit report, and stay cautious about where you share your information.

As more details about this breach emerge, continue to stay informed and proactive. This situation is still unfolding, and while we may not have all the answers yet, taking these steps can help safeguard your personal information.

If you have any concerns or notice any suspicious activity, don’t hesitate to reach out to your bank or a financial advisor for assistance. In the meantime, keep an eye on the news for updates on this developing story, and take comfort in knowing that there are steps you can take to protect yourself.

And finally, if you haven’t done so already, consider subscribing to trusted sources of information to stay updated on this and other important news. We’re all in this together, and by staying informed, we can better protect ourselves in the digital age.