As the 2024 presidential race heats up, the spotlight intensifies on Vice President Kamala Harris, who has emerged as the Democratic frontrunner following President Joe Biden’s unexpected withdrawal.

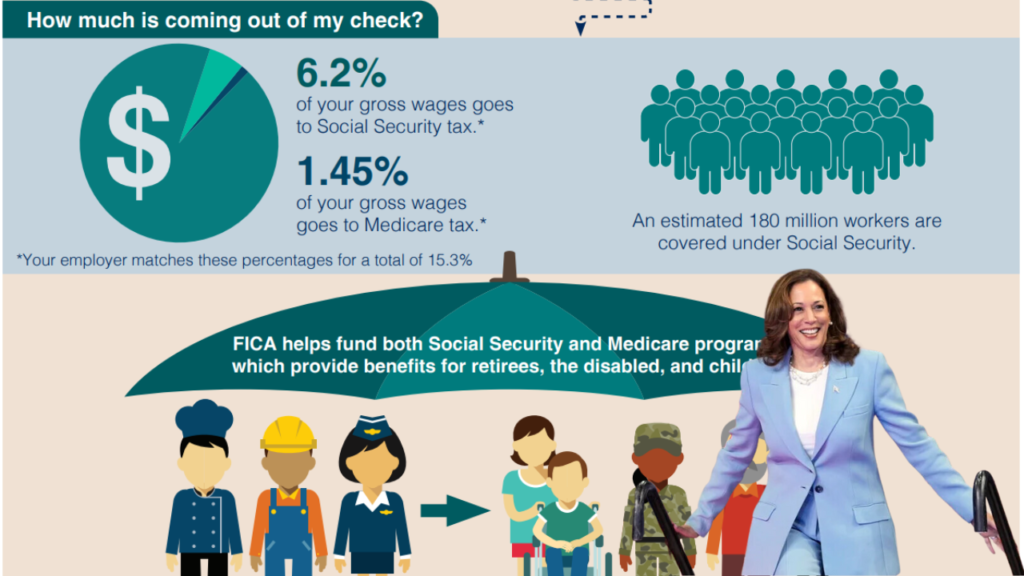

With Biden’s endorsement, Harris’s policy stances, particularly those related to Social Security, are under scrutiny.

Middle-class retirees, who often rely on Social Security for a significant portion of their retirement income, are especially concerned about what Harris’s potential presidency could mean for them.

Background on Harris’s Social Security Proposals!

Kamala Harris has not fully detailed her Social Security strategy, but her alignment with the Biden administration suggests a continuation of its policies.

Key proposals include taxing higher incomes to sustain the Social Security fund, revising the cost-of-living adjustment (COLA) formula, and enhancing benefits for certain groups.

These changes aim to ensure the program’s solvency and adapt its benefits to better match the current economic landscape.

$12,897 More in Your Pocket? What Does Trump’s Election Mean for Your Social Security?

Analysis of Potential Benefits for Middle-Class Retirees!

1. Taxing Higher Incomes

The proposal to tax earned income above $400,000 could bolster the Old Age and Survivors Insurance (OASI) Trust Fund, which is predicted to deplete its reserves within the next decade.

For middle-class retirees, the direct benefit would be a more secure Social Security system that can continue to pay out benefits without drastic cuts.

2. Changing the COLA Formula

Switching the COLA calculation from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to the Consumer Price Index for the Elderly (CPI-E) could result in more generous annual increases for retirees.

The CPI-E tends to rise faster than the CPI-W because it accounts for seniors’ spending patterns, particularly their higher medical costs.

3. Raising the Primary Insurance Amount (PIA)

Harris supports increasing the PIA for recipients between the ages of 78 and 82. This change would provide a financial boost to older retirees who are more likely to have exhausted their personal savings and face escalating healthcare expenses.

Surprising Social Security Loophole for 50-Year-Old Retirees: Find Out If You Qualify!

Challenges and Considerations!

While these proposals could provide significant benefits, they are not without challenges. Achieving legislative approval will be a formidable task, requiring Harris to navigate a potentially divided Congress.

Moreover, the proposals could face opposition from those who view them as paving the way for future tax increases or benefit reductions.

Implications for Retirement Planning!

Given the uncertainty surrounding these changes, middle-class retirees should consider revisiting their retirement strategies.

Financial advisors often recommend diversifying income sources and planning for various scenarios, including changes in Social Security benefits.

Being prepared for different outcomes can help mitigate the impact of any potential policy shifts.

Act Now: Your Social Security Payment Dates Have Changed—Find Out When You’ll Get Paid!

Conclusion

Kamala Harris’s proposed Social Security reforms could significantly impact middle-class retirees, offering them potential benefits through increased funding stability and adjusted benefit calculations.

However, the realization of these benefits largely depends on political factors and the ability to enact legislative changes.